Find in this article six possibilities to reduce your Income Tax and the amount of the tax reduction to which you are entitled.

-

Make a donation

Making a donation allows you to reduce your Income Tax (IR) by:

-

Employ someone from home

Housekeeping, computer repair, tutoring, gardening …

If you hire someone to perform such a task at your home for a fee, you benefit from a tax credit equal to 50% of your expenses, withheld up to a ceiling of between € 12,000 and € 20,000. per year depending on the composition of your tax household.

To note

Certain services give entitlement to the tax advantage within limits: € 500 per year for small DIY work, the duration of an intervention not to exceed two hours; € 3,000 per year for computer and internet assistance expenses at home; € 5,000 per year for small gardening work.

-

Fund a retirement savings product

The sums saved for your personal retirement are deductible from your taxable income up to 10% of your professional income from the previous year. For 2021, the deduction is capped at 32,909 euros. Working people with modest incomes and those inactive benefit from a minimum deduction of 4,114 euros.

The tax authorities authorize you to add to your annual deduction limit the part of that to which you were entitled for the last 3 years but which you have not used. If you are married or in a civil partnership, you can also increase your deduction limit by the part of the deduction limit for the current year of your spouse or partner that he has not used.

This deduction gives you a tax saving proportional to your marginal tax rate. The higher it is, the more you reduce your taxes.

-

Make a real estate rental investment

You can build up real estate assets while benefiting from a tax reduction. However, you must commit to renting the property for a given period (6 years minimum). In addition, important constraints are imposed on you, such as respecting a rent ceiling or choosing a tenant with limited resources. There are several types of tax-exempt rental investments:

-

Buy SOFICA shares

The Companies for the Financing of the Cinematographic or Audiovisual Industry ( SOFICA ) finance the production of French audiovisual and cinematographic works. You can buy SOFICA shares, subject to availability, in order to reduce your IR. The tax reduction goes up to 48% of the amount of your investment, up to a limit of € 18,000 per year, under certain conditions.

-

Improve the energy characteristics of your home

Thanks to the Energy Transition Tax Credit (CITE), you can deduct from your IR a fraction of your expenses intended to improve the energy performance of your main residence (subject to eligibility of the work). The tax reduction is equal to a fixed amount varying according to the work carried out. For expenses paid in 2020, households with modest incomes are no longer entitled to the CITE, but to a premium paid upon completion of the work. “MaPrimeRénov ‘” replaces the CITE in 2021, for all households.

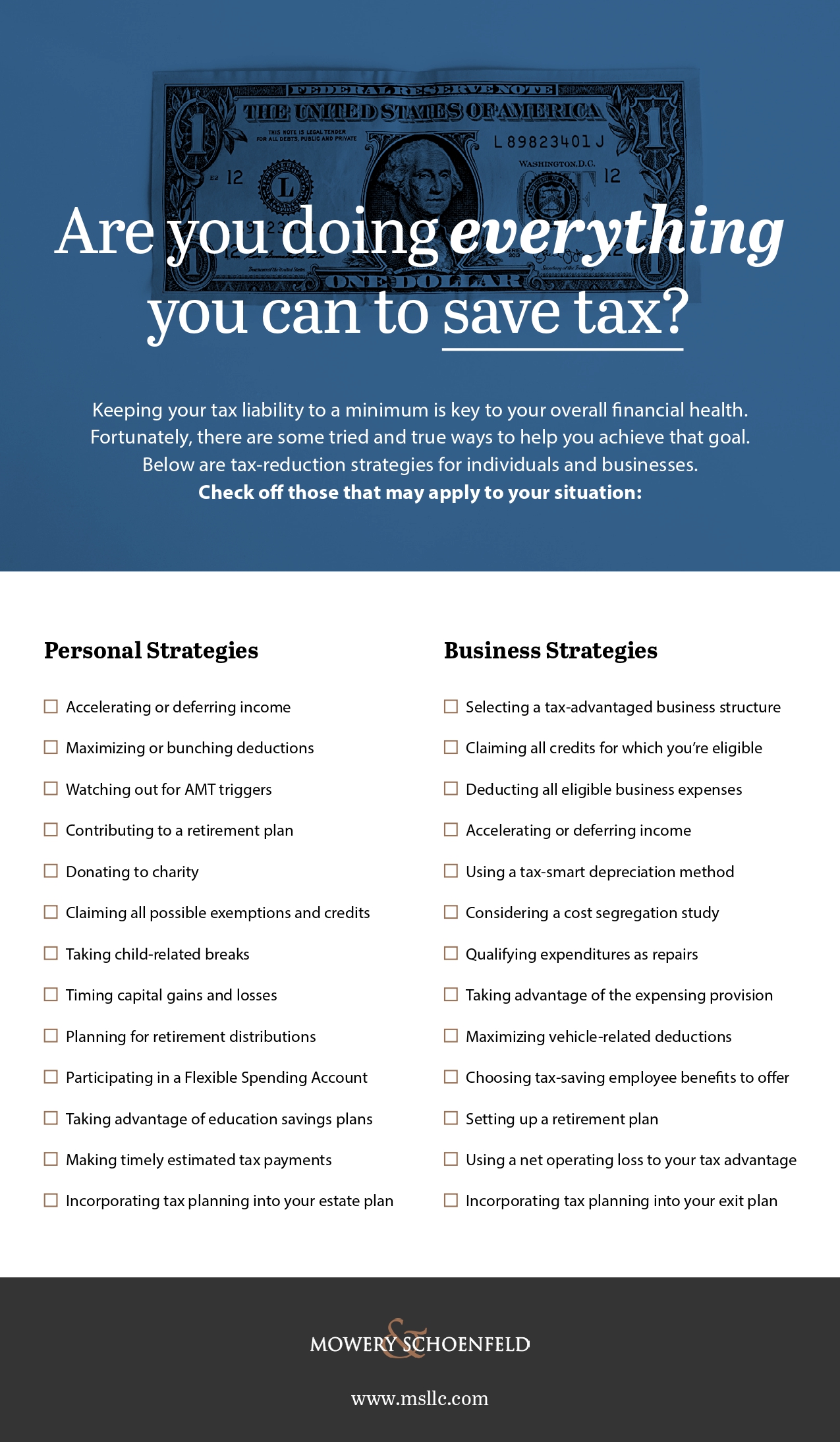

Check out the infographic below for more tips to save tax dollars!

Infographic provided by Mowery & Schoenfeld, LLC., a Chicago business tax service provider