Increasing one’s financial standing is desirable. However, we are only at the beginning of the process. It is essential to raise the value of the money that has already been accumulated. This is also where different types of investment vehicles, such as mutual funds, play an important role. In a nutshell, mutual funds are investment pools that also are managed by experienced fund managers. This is just a basic introduction to equity funds.

Invest using a SIP calculator

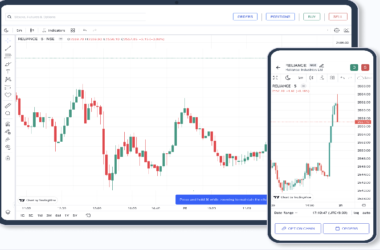

Such managers combine the capital contributed by a variety of investors and then invest it in various financial assets such as equities, bonds, and money-market instruments, including worldwide funds, with the goal of achieving superior rates of return. The phrases systematic investment plan (SIP) as well as mutual funds are frequently interchangeably used by the general public. On the other hand, there is a significant distinction between them. Investors could use SIP calculators for smart and affordable investments.

How to use a SIP calculator to customize an investment plan for a systematic investment strategy

The vast majority of mutual fund SIP calculator operate under the assumption of a static scenario, which entails continuously investing a predetermined amount of money on a monthly basis over a period of a few years. Due to the fluid nature of life, doing so can result in wrong assumptions as well as consequences, despite the fact that it is straightforward and convenient. Your income, and hence the number of discretionary funds you have available to spend, will almost certainly increase year after year. If you have structured your cash flows strategically with the assistance of an investment manager, there is a good chance that you’ll be able to increase the amount of money you invest in your SIP each year.

Just enter the details and know the SIP amount

This is the very situation in which a step-up SIP Calculator might prove to be useful! A step-up SIP Calculator offers you a far more precise number whenever it comes to the expected achieving objectives from your SIP Investment. This is accomplished by allowing you to see outcomes based on a set amount or percentage step up per year.

While making plans for long-term goals, where even small tweaks in the investment variables may have a spectacular effect on the final corpus prediction, a step-up SIP calculator could indeed demonstrate to be particularly useful. This is because even the smallest changes in the investment variables can have a major impact.

It assists in the estimation of potential future returns

The results returned from the SIP investment calculator are quite close to being correct. This is due to the fact that the SIP calculator levels the playing field for novice investors as well as professional investors. In turn, this could help the investor profit from mutual funds investments by assisting them in estimating the returns that they will receive in the future.

For instance-

- All that is required of you is to fill in some basic details, including the amounts you want to invest in the SIP and the duration of the investment.

- After you have made your choices, the SIP calculator should immediately and efficiently estimate your final amount, which should just take a few seconds.

- If you are putting money away with the intention of achieving a particular objective, careful planning of your investments is absolutely necessary.

Using the SIP Calculator, you’ll be able to get a better estimate of how much money you’ll need to put away each month in order to achieve your desired level of investment performance with the least amount of work.

Conclusion

Unquestionably, no, a one-time investment of a large sum of money will not allow you to make use of the advantages of rupee-cost averaging. You can protect yourself from the ups and downs of the market by using a systematic investment plan (SIP). With this type of plan, you purchase more stock whenever the price is low, as well as fewer shares whenever it is high.