Free-float market capitalization in Sensex, India, is one of the most common ways to measure the performance of stock markets. Free-float market capitalization is the market capitalization of shares issued by a company. The company’s market capitalization is the value of its shares multiplied by the number of shares outstanding, equal to the firm’s market capitalization. If there are no shares outstanding, then the market capitalization equals zero.

It is helpful to determine the market value of a company or index based on how much money a company or index commands from the market. A company or index that is less expensive than the rest of the market is said to have a lower free-float market capitalization and hence has a higher market value. Conversely, a company or index with a higher free-float market capitalization is more expensive than the rest and has a lower market value.

The Free-float Market Capitalization in Sensex is an indicator for the market capitalization of Sensex. The free-float market capitalization is the Market Capitalization with the shares not owned by the company benchmarked.

It is usually a close watch measure of company performance due to its close relationship to its free cash flow and profitability.

It is the market capitalization of the equity-free of the non-controlling interests. The Free-float Market Capitalisation is the value of the companies included in the index, not including the cost of the index. The index gets constructed as a weighted average of the price of the companies that comprise the index. As a result, the value is not the same as the market capitalization.

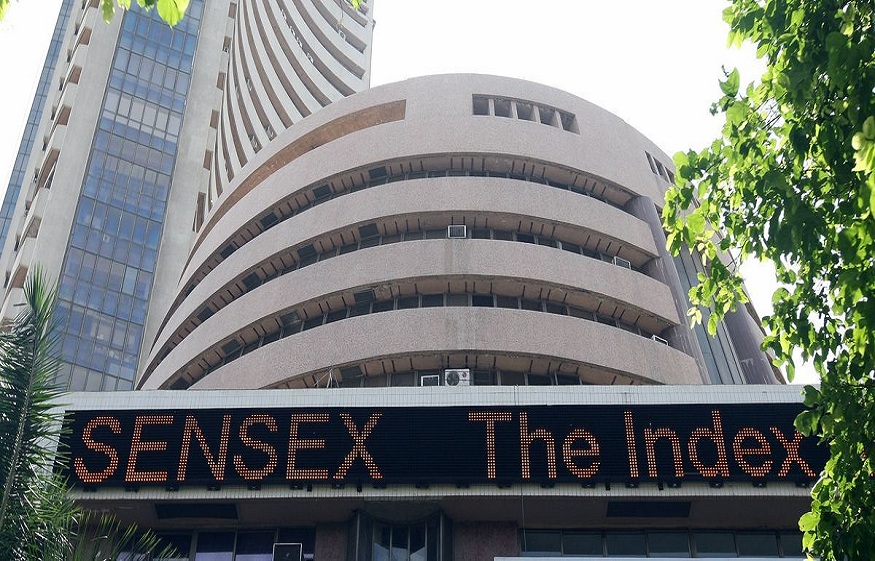

What is Sensex?

Sensex is a 30 stocks index. It was created in 1986 by the National Stock Exchange of India Ltd. in collaboration with the Bombay Stock Exchange Ltd. and the National Stock Exchange (NSE) of Mauritius Ltd. As of March 2013, the stock index has a market capitalization of Rs. 7.5 lakh crore (Rs. 700 billion), or about 9% of the country’s GDP. Sensex is a stock market that the Bombay Stock Exchange Ltd. operates. It is the biggest stock market in India and is one of the leading stock exchanges in the world. It is currently the world’s fourth-largest stock market by market capitalization with a free-float market capitalization of 1 trillion dollars.

The Mumbai Sensex allows you to track the total market capitalization of the equity component of the Indian capital market. Getting the market capitalization to be a part of the Sensex, company shares need to be traded on the Stock Market. After opting for an upcoming IPO it is possible for shares to be traded and to eventually get the capitalization to be part of the indicator.

What Does the Share in Your Portfolio Mean?

A share is the unit of ownership in a company an investor holds. The investor has a right to receive when they buy and own the company. A share represents a certain fraction of an investor’s portfolio’s total assets (or market cap). When the investor buys a share, they are buying a company.

Calculating the Free- Float Market Capitalization

It is a method to calculate the underlying market cap index by multiplying the price of the shares with the count of the shares (that does not include the shares held by the government, insiders, and the promoters). The free-float market capitalization is the market capitalization of the equities that the company does not have. You can calculate it by considering the number of outstanding shares and the market cap of each constituent share. It is the market cap of the underlying index, not the company’s market capitalization, which is the company’s total value.

What is a Good Free-float Market Capitalization?

A good free-float market capitalization is less than the company’s market cap. It helps one determine if the company is overvalued and could be an excellent time to sell. A company has a lower free-float market cap when its free-float market cap is lower than the index’s market cap. The free-float market capitalization is good when it is about 1.5 times its net worth. It also serves as an indicator to tell whether or not the company is overvalued or undervalued. It can also show whether the company is worth buying.

What are the Advantages of Free-float Market Capitalization?

- Free-float market capitalization is the market capitalization of a stock market index, not including the cost of the index. It is usually a close watch measure of company performance due to its close relationship to its free cash flow and profitability.

- Free-float market capitalization is one of the most popular indices for stock market analysis. Free-float market capitalization is a good measure for financial markets because it directly reflects its current financial health.

In addition, it is a close watch measure for company performance due to its close relationship to its free cash flow and profitability. A company with a high free-float market capitalization is usually more profitable than a low one.

- One of the essential advantages of using free-float market capitalization is that it is a close watch measure of company performance due to its close relationship with its free cash flow and profitability. In addition, it is the market capitalization of the equity-free of the non-controlling interests. Therefore, it is often known as the ‘Equity-free Market Capitalization.’

- Free-float market capitalization is one of the most popular valuation techniques. The reason for using free-float market capitalization is that it removes the influence of the controlling shareholders and allows the index or market to become more representative of the market.