Powerful New Tool from the Leading Restaurant Management and Bill Payment Platform

Designed to Automate Processes, Simplify Workflow and Provide Valuable Insights

ARLINGTON, Va., June 26 2023 – MarginEdge, the leading restaurant management and bill payment platform, today announced the official launch of an innovative new finance tool, [me] finance, the only accounts payable automation solution built exclusively for restaurant accountants and bookkeepers.

Designed to automate manual processes and simplify workflows, [me] finance eliminates the need for data entry and turns invoice and sales data into powerful reports to help accounting professionals track and manage everything coming into a client’s restaurant.

Among the key benefits of [me] finance, accountants and bookkeepers can access:

- Automated Invoice Processing – Simply scan, email or take a photo of an invoice and the details will be captured and digitized in less than 48 hours to give an up-to-date picture of food costs.

- Robust Financial Reporting – Visual budget tracking, controllable P&L statements, category reports and sales data help make for more informed financial decisions, such as investing in profitable segments of the restaurant or cutting back on underperforming ones.

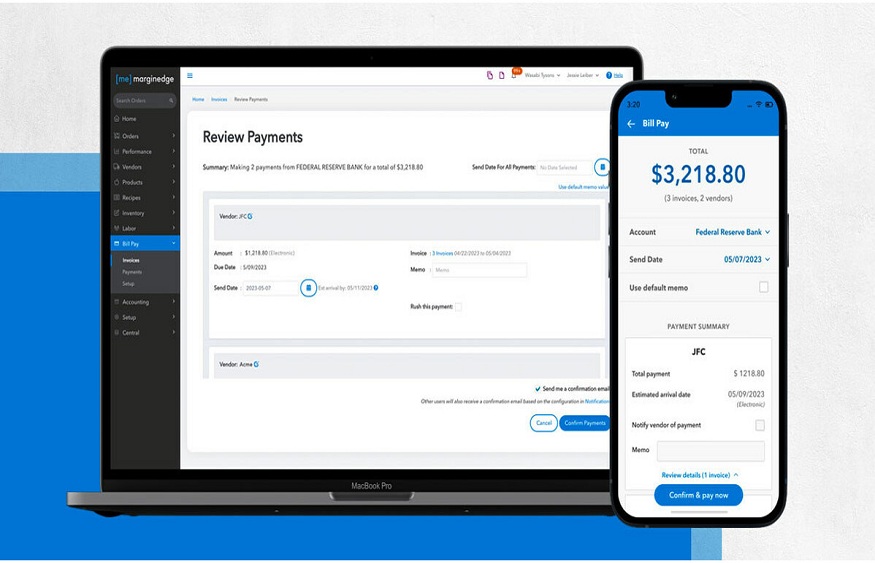

- Back Office Efficiencies – Pay or schedule an unlimited amount of payments so they are always on time. Invoices can move from “approved” to “paid” in as little as two business days – automatically syncing to the accounting system and providing consistent proof of payment. Know which invoices have been paid and which are still outstanding – helping the prioritization of payments and more visibility into cash flow.

- Flexible Payment Options – Customers have the option to pick from our vast network of over 55,000 industry-specific vendors or enroll their own vendors in electronic payments. [me] finance also takes care of the check writing, stuffing and sending – all for one flat rate, no additional fees or cost per invoice.

- Automatic Vendor Credit Tracking – The first AP automation provider to track credits, making sure restaurants never pay a cent more than what they owe.

- Multi-Unit Management – Streamline multi-unit management and ensure consistency across locations with one centralized platform for standardized payments.

- POS and Accounting Integrations – Sales data is pulled nightly from a restaurant’s POS along with bills marked as “Paid” and instantly exported to accounting software like QuickBooks, making it easy to reconcile payments and keep books up-to-date.

The new product is available exclusively to bookkeeping and accounting firms for a flat fee of $100 per month per restaurant client based on an annual subscription.

“Just as we fully understand the challenges of restaurant owners and operators, this new product is specifically designed to meet the needs of accountants and bookkeepers, saving an incredible amount of time and frustration, while offering insights to help their restaurant clients better track inventory, reduce waste and boost profits,” said MarginEdge CEO Bo Davis.

Margin Edge was recently recognized as one of The Americas’ Fastest Growing Companies in 2023 by the Financial Times and on the 2022 Inc. 5000 Annual List. Best workplace awards in 2023 include Inc.’s Best Workplaces, The Washington Post Top Workplace and Washington Business Journal Best Places to Work.

About MarginEdge

MarginEdge’s mission is to create a world where restaurant operators can focus on the business they love. By using best-in-class technology to eliminate unproductive paperwork and streamline the flow of operational data, MarginEdge is reimagining the back office and freeing restaurants to spend more time on their culinary offerings and guest experiences. The platform offers market-leading invoice processing, inventory management, recipe analysis, budgeting, performance tracking and supplier bill payment capabilities. Founded by industry veterans, MarginEdge serves a diverse group of operators from single units and small chains to large franchise and hospitality groups, providing a high impact product that resonates across the hospitality industry. For more information visit marginedge.com