A retirement fund is the most crucial corpus that one will create in their lifetime. For many people, retirement signifies the sudden stoppage of their income. This makes it imperative to create a sound retirement corpus that can support them financially for the rest of their life.

What is a retirement corpus?

A retirement corpus is the sum of money necessary to provide a steady income after retirement. It is computed using the individual’s age, the number of years before retirement, inflation during the accumulation phase, and the predicted rate of return during retirement years. It is determined by assessing the present income, the predicted rate of growth of the income, and the expected retirement expenses. After determining these numbers, a retirement calculator or spreadsheet tool can be used to compute the retirement corpus.

Retirement investment options to choose from

Deciding on the right investment options can be challenging and it is important to choose the right ones to secure a comfortable retirement. Read on to find out more about retirement investments and see whichone will fit the best in your portfolio.

1. Equity funds

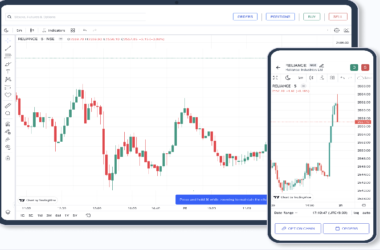

Due to their high returns and diversification, equity funds are a useful tool for accumulating a corpus for retirement. Equity funds invest in stocks and provide access to the stock market, allowing you to reap the benefits of market growth over time. They are also comparatively low-risk investments compared to others such as cryptocurrencies and commodities.

To make the most of equity funds for establishing a retirement corpus, one must have a comprehensive awareness of the markets, the risks connected with the funds, and the different fund categories. In addition, it is essential to choose a fund that fits your investment objectives and risk tolerance. Lastly, it is essential to diversify across different asset classes and also across different funds.

2. National Pension System

The National Pension System (NPS) is a government-sponsored pension programme for government employees that was established in 2004. In 2009, it was expanded to all sections, allowing any Indian citizen aged 18 and above to contribute to the system. Contributions to the NPS are administered by PFRDA-registered pension fund managers and provide tax advantages.

3. Recurring deposits

Recurring deposits allow you to invest a set amount of money each month for a set length of time. At a predetermined rate, interest is generated on the amount deposited. Every month, the interest generated is compounded and added to the principal. This assists in amassing a good corpus at the end of the term.

The period of the RD might range from six months to 10 years, with no upper limit on the amount invested. Most banks allow you to compound interest quarterly, semi-annually, or annually. The most advantageous choice is to choose yearly compounding of interest.

Conclusion

Choosing the right retirement fund& right investments requires careful planning and analysis. Equity funds and NPS are some of the popular investment options for building a retirement corpus. It is important to consider factors such as your investment objectives, risk tolerance, and personal financial situation while making your investment choices.